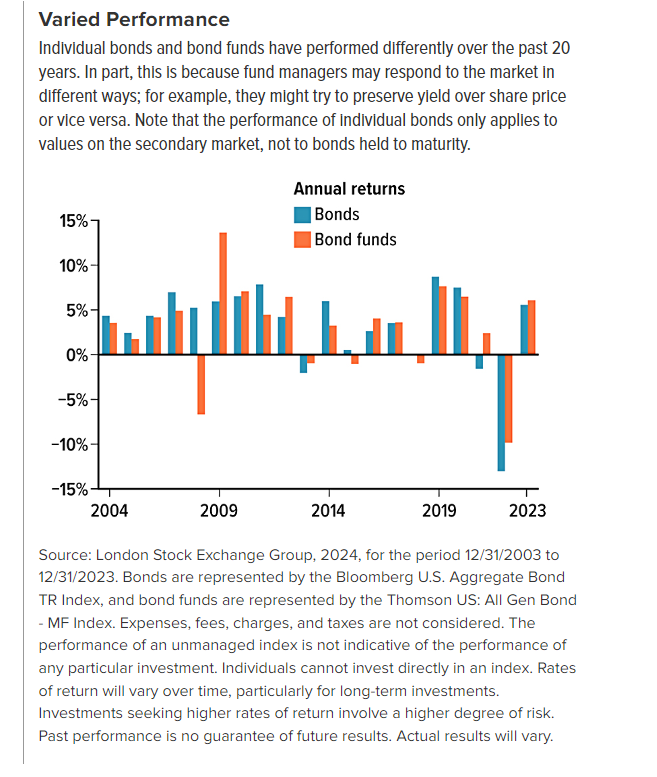

Individual bonds and bond funds can both provide an income stream, but there are important differences. An individual bond can offer more certainty and stability than a fund, while a fund can offer diversification that might be difficult to obtain with individual bonds.

n individual bond has a coupon rate — the annual interest rate paid on the face value of the bond — and a maturity date, which is the date the principal is returned to the borrower. If you hold a bond to maturity, you will receive any interest payments due during the time you own it (typically paid quarterly or semi-annually) and the full principal at maturity, unless the bond issuer defaults. If you sell the bond on the secondary market before maturity, you will receive the market price, which may be higher or lower than the face value or the amount you paid, depending on market conditions.

By contrast, a bond fund does not have a coupon rate or a maturity date (with the exception of certain defined-maturity funds). A fund typically pays monthly distributions based on the bonds in the fund. The rate can change as bonds are replaced (due to maturity or sales), and as market conditions change. A fund also has fees and expenses, which reduce the interest paid, and fund managers can adjust to market conditions in various ways, depending on the fund’s objective. Because there is no maturity date, you can hold the fund as long as the fund company remains in business. However, there is never a guarantee that you will receive your principal no matter how long you hold the shares. Fund shares, when sold, may be worth more or less than your original investment.

Yield is the expected return from a bond or bond fund, based on the interest rate and purchase price. If you buy a $1,000 bond at face value with a coupon rate of 4%, the yield is 4%. But if you buy the same bond on the secondary market for $800, the yield is 5%, because you receive interest based on the face value: 4% x $1,000 face value = $40 interest / $800 purchase price = 5% yield. Bond fund yields are more complex, but the 30-day SEC yield (or standardized yield) offers a helpful comparison. This is typically calculated using the maximum share price on the last day of the month and projects annual net investment income assuming it remains the same as the previous 30 days.

Bonds and bond funds are sensitive to changes in interest rates. Generally, when rates rise, the market value of existing bonds and bond funds falls, because newly issued bonds pay higher interest rates. Conversely, when rates fall, the market value of existing bonds and bond funds rises. This only applies to market values and would not affect an individual bond held to maturity.

If you owned bond funds during the period that the Federal Reserve was aggressively raising interest rates, you may have been frustrated as you watched the value of your shares drop. Now that interest rates seem to have stabilized, share values are likely to stabilize as well, and they may increase if rates begin to decrease. Bond funds typically replace underlying bonds as they mature, and new bonds added to funds over the last two years will generally pay higher interest rates, increasing the interest paid by the fund. Although it is impossible to predict future market direction, bond funds may be poised to offer solid returns if rates remain stable or begin to fall.

Diversification does not guarantee a profit or protect against investment loss. Funds are sold by prospectus. Please consider the investment objectives, risks, charges, and expenses carefully before investing. The prospectus, which contains this and other information about the investment company, can be obtained from your financial professional. Be sure to read the prospectus carefully before deciding whether to invest.

Financial Advisor

Louis Financial Group, LLC

7971 Riviera Blvd Suite 326| Miramar, FL 33023

Phone:(954)505-2927 x930 |Fax:(954)681-4195

The information provided is not written or intended as specific tax or legal advice and may not be relied on for the purpose of avoiding any federal tax penalties. Louis Financial Group, LLC, its employees, and representatives are not authorized to give tax or legal advice. Individuals are encouraged to seek advice from their own tax or legal counsel based on their individual circumstances.

Also, the information presented here is not specific to any individual’s personal circumstances. These materials are provided for general information and educational purposes based upon publicly available information from sources believed to be reliable— we cannot assure the accuracy or completeness of these materials. The information in these materials may change at any time and without notice.

This communication is strictly intended for individuals residing in the state of FL. No offers may be made or accepted from any resident outside the specific states referenced.

Prepared by Broadridge Advisor Solutions Copyright 2023.

Investment advisory and fee-based financial planning services are offered through LFG Wealth Management, LLC, a State (FL) registered Investment Advisory Firm. 7971 Riviera Blvd Suite 326, Miramar, FL 33023 (954)526-5240. Additional information about LFG is also available via the SEC’s website: http://www.adviserinfo.sec.gov.You can search this site using a unique identifying number, a CRD number. The CRD number for LFG is 171123.

LFG Wealth Management, LLC offers access to securities through Altruist Financial LLC, a self-clearing broker-dealer. Member FINRA/SIPC. Check the background of Altruist Financial LLC on FINRA’s Broker Check. Shareholders Service Group, Inc. (“SSG”) is also a member of FINRA/SIPC with clearing and custody provided by Pershing LLC, Member SIPC. LFG Wealth Management, LLC’s clients establish brokerage accounts through Altruist. LFG Wealth Management, LLC maintains an institutional relationship with Altruist whereby Altruist provides certain benefits to LFG Wealth Management, LLC, including a fully digital account opening process, a variety of available investments, and integration with software tools that can benefit LFG Wealth Management, LLC, and its clients.

Insurance products are offered through Louis Financial Group, LLC, and Louis Insurance Agency, Inc, licensed insurance agencies registered in Florida. Tax and Accounting Services are offered through LFG Accounting Services, LLC. LFG Wealth Management, LLC, LFG Accounting Services, LLC, Louis Financial Group, LLC, and Louis Insurance Agency, Inc are not affiliates or subsidiaries of Shareholder Service Group, Inc, Altruist LLC, and Altruist Financial LLC.

"*" indicates required fields

Get the latest insurance, retirement, and financial planning news.