What does living life, according to your terms, mean to you?

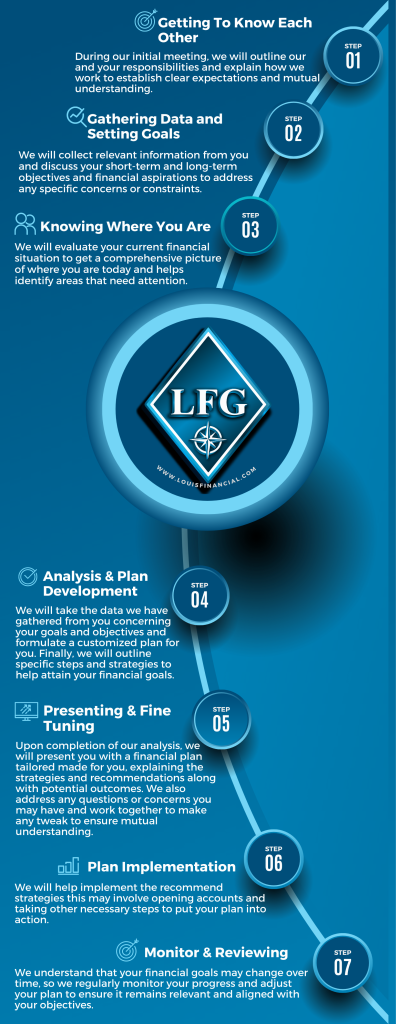

Creating a plan is a great starting point, whatever your vision may be.

The prospect of needing assistance with daily activities such as bathing, eating, or getting dressed is something people want to avoid dwelling on. However, as life expectancies increase, long-term care has become a potential reality for many individuals and their families.

Whether provided at a nursing home, assisted living facility, or home care services, the cost of long-term care can amount to thousands of dollars every month.

As we age, there may come a time when we require assistance with our personal care needs. Long-term care (LTC) is specifically designed to provide ongoing health and personal care support. This may include non-skilled assistance with everyday Activities of Daily Living (ADLs) such as bathing, dressing, toileting, transferring, incontinence care, and meal preparation.

The necessity for long-term care can arise unexpectedly and affect anyone, regardless of their age. It may stem from chronic illness, severe cognitive impairment, or even accidents or injuries. With longer life expectancies, retirement can last for many years, but it also increases the likelihood of developing health issues associated with aging.

Planning for long-term care insurance can be quite costly. However, being proactive can guarantee that your retirement plans are not derailed by an LTC occurrence and that the effect on your loved ones is reduced. It’s important to create a plan now, and Louis Financial might be able to help you find a way.

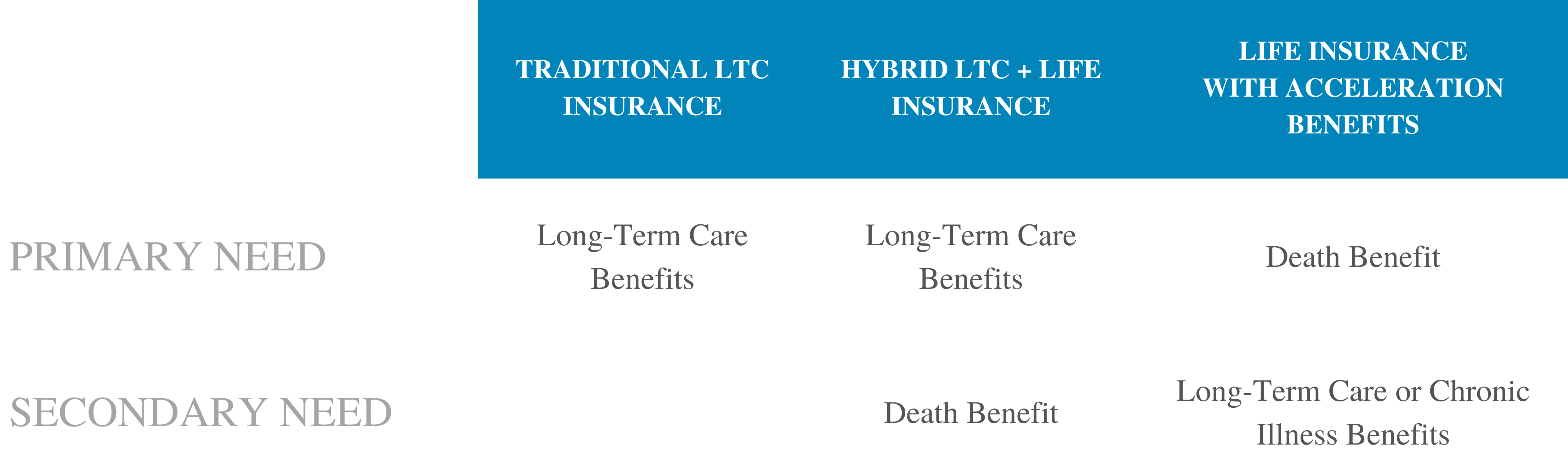

Several viable options exist when it comes to covering the cost of long-term care. These include relying on personal savings, seeking support from family and friends, applying for home equity loans, and exploring state Medicaid programs. Additionally, it may be beneficial to look into various insurance options:

Long-term care insurance is a policy that aims to assist with the expenses related to extended care financially.

Life insurance policies with a long-term care benefit included.

These are attached to a life insurance policy and would allow you to use a portion of your policy’s death benefit, once certain conditions are met, for long term care or chronic illness needs.

Investment advisory and fee-based financial planning services are offered through LFG Wealth Management, LLC, a State (FL) registered Investment Advisory Firm. 7971 Riviera Blvd Suite 326, Miramar, FL 33023 (954)526-5240. Additional information about LFG is also available via the SEC’s website: http://www.adviserinfo.sec.gov.You can search this site using a unique identifying number, a CRD number. The CRD number for LFG is 171123.

LFG Wealth Management, LLC offers access to securities through Altruist Financial LLC, a self-clearing broker-dealer. Member FINRA/SIPC. Check the background of Altruist Financial LLC on FINRA’s Broker Check. Shareholders Service Group, Inc. (“SSG”) is also a member of FINRA/SIPC with clearing and custody provided by Pershing LLC, Member SIPC. LFG Wealth Management, LLC’s clients establish brokerage accounts through Altruist. LFG Wealth Management, LLC maintains an institutional relationship with Altruist whereby Altruist provides certain benefits to LFG Wealth Management, LLC, including a fully digital account opening process, a variety of available investments, and integration with software tools that can benefit LFG Wealth Management, LLC, and its clients.

Insurance products are offered through Louis Financial Group, LLC, and Louis Insurance Agency, Inc, licensed insurance agencies registered in Florida. Tax and Accounting Services are offered through LFG Accounting Services, LLC. LFG Wealth Management, LLC, LFG Accounting Services, LLC, Louis Financial Group, LLC, and Louis Insurance Agency, Inc are not affiliates or subsidiaries of Shareholder Service Group, Inc, Altruist LLC, and Altruist Financial LLC.

"*" indicates required fields